Extraordinary performance of Rioja exports in 2024 with a growth of 4.42% (vs. 2023)

- Total sales of Rioja grew by 0.63% in 2024, with more than 240 million liters sold, despite the general decline in global wine consumption

- The QDO (Qualified Designation of Origin) maintains its leadership position and competitive advantage in the domestic market, with a 30.44% share in value.

February 14th, 2025. In an adverse global context for wine sales and a fall in consumption worldwide, Rioja Qualified Designation of Origin presents a positive balance with a growth in sales of 0.63% in 2024, with 328,461,466 bottles sold, equivalent to 240,046,448 liters.

In the domestic market, the specialized consulting firm Nielsen confirms that the recessionary situation continues, with declines in domestic wine consumption. In this context, Rioja sold 141,218,785 liters in this market last year, 1.87% less than in 2023. However, according to an initial preview of the data provided by the consulting firm, this did not prevent the DOCa Rioja from continuing to be the benchmark appellation in Spain, with a 26.8% share in volume (vs. 27.1% in 2023), maintaining its competitive advantage and capturing 30.44% of the market share in terms of value.

Within the Spanish market, by color, the growth of Rioja whites stands out, up 1.9% on the previous year, which had already grown by 7.13% according to the last balance sheet. By type, the “Reserve” category led growth, with a 7% increase in volume.

Internationally, where the situation is particularly unfavorable for the wine sector and its consumption, with a decline from January to November 2024 of -11.46% in exports of Spanish DO wine according to the Spanish Wine Market Observatory (OEMV), Rioja sales abroad grew by 4.42%, with 98,827,453 liters marketed in 2024, exporting to 135 countries. In this way, Rioja reinforces its competitive export advantage over other wine regions, a benchmark for quality Spanish wine outside Spain.

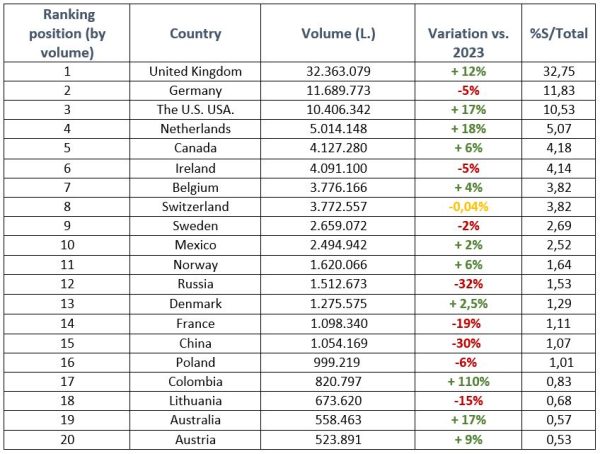

Considering the absolute volume of shipments to the different markets, the positive performance in 2024 in the United Kingdom (Rioja’s main market) stands out, with a growth of 12%. Also noteworthy was the positive performance of the United States, the second most important market for Rioja in terms of value and third in terms of volume, with a growth of 17%, as well as the majority of strategic markets for the Wine Region. Other markets that are also important for Rioja, such as Germany (2nd ranking) and Ireland (6th) have, however, experienced declines.

By color, Rioja red wines were particularly thumping on the foreign market, with an increase of 5.32% and, by type, all categories grew, especially the “Crianza” category, with an increase of 8.7%, except for the “Gran Reserva” category, which remained practically flat, with a slight decrease.

“Although our region is not immune to the economic situation, Rioja sales have responded better than our competitors’, and the fact that in such complicated commercial contexts as the one we are going through, Rioja’s commercialization has grown, albeit modestly, demonstrates once again the confidence that consumers have in Rioja, their preference for this region and the strength of its century-old brand”, said Fernando Ezquerro, president of the Regulatory Council of Rioja Qualified Designation of Origin.

Rioja in its commitment to balance

Taking into account the behavior of stocks, and the progress achieved after the implementation in 2023 and subsequent review of the Plan for the Recovery of Balance, as well as the effectiveness of specific measures such as distillation and green harvesting, the ratio of stocks in Rioja shows a downward trend, falling to 3.38, bringing it notably closer to the average period of permanence of wines marketed in 2024. Given the progress made after the implementation in 2023 and the subsequent review of the Plan for the Recovery of the Balance, as well as the effectiveness of specific measures such as distillation and green harvesting, the stock ratio of the Rioja QDO shows a downward trend, falling to 3.38, coming remarkably close to the average period of permanence of wines marketed in 2024, of 3.12 years.